Unknown Facts About Whole Farm Revenue Protection

Wiki Article

Whole Farm Revenue Protection Fundamentals Explained

Table of ContentsThe 10-Second Trick For Whole Farm Revenue Protection3 Easy Facts About Whole Farm Revenue Protection DescribedHow Whole Farm Revenue Protection can Save You Time, Stress, and Money.The smart Trick of Whole Farm Revenue Protection That Nobody is DiscussingWhole Farm Revenue Protection Can Be Fun For EveryoneThe 25-Second Trick For Whole Farm Revenue ProtectionThe 30-Second Trick For Whole Farm Revenue Protection

Ranch and ranch residential or commercial property insurance policy covers the properties of your ranch as well as ranch, such as livestock, tools, buildings, installations, and others. These are the typical insurance coverages you can get from farm and ranch residential property insurance policy.Your farm and ranch makes use of flatbed trailers, confined trailers, or energy trailers to haul items and also devices. Commercial automobile insurance coverage will certainly cover the trailer yet only if it's connected to the insured tractor or vehicle. If something takes place to the trailer while it's not connected, after that you're left on your own.

Employees' settlement insurance gives the funds a worker can utilize to acquire medicines for a job-related injury or illness, as prescribed by the physician. Workers' settlement insurance covers rehabilitation.

Rumored Buzz on Whole Farm Revenue Protection

You can guarantee on your own with employees' compensation insurance coverage. While buying the policy, service providers will certainly give you the freedom to include or omit yourself as a guaranteed.

Facts About Whole Farm Revenue Protection Uncovered

Many ranch insurance service providers will additionally use to compose a farmer's vehicle insurance. In some scenarios, a farm insurance policy service provider will just supply specific kinds of automobile insurance or just insure the automobile threats that have operations within a particular extent or range.

No issue what carrier is composing the farmer's automobile insurance coverage policy, heavy as well as extra-heavy trucks will certainly need to be placed on a industrial car plan. Trucks entitled to an industrial ranch entity, such as an LLC or INC, will require to be placed on a business policy no matter of the insurance coverage carrier.

If a farmer has a semi that is made use of for transporting their own ranch products, they might be able to include this on the exact same business automobile plan that guarantees their commercially-owned pickup. Nonetheless, if the semi is made use of in the off-season to transport the items of others, a lot of typical ranch and business car insurance service providers will not have an "cravings" for this type of risk.

Not known Details About Whole Farm Revenue Protection

A trucking policy is still a business automobile plan. However, the carriers who supply coverage for operations with cars made use of to transport items for 3rd parties are usually concentrated on this kind of insurance policy. These sorts of procedures develop greater threats for insurance firms, larger claim quantities, as well as a greater severity of insurance claims.A knowledgeable independent agent can help you analyze the kind helpful hints of plan with which your commercial vehicle ought to be insured and also explain the nuanced implications and also insurance policy ramifications of having numerous auto plans with numerous insurance policy carriers. Some trucks that are used on the ranch are guaranteed on individual automobile policies.

Business automobiles that are not qualified for a personal auto policy, however are made use of solely in the farming procedures supply a reduced risk to insurance firms than their business use equivalents. Some providers choose to guarantee them on a ranch car plan, which will have a little various underwriting criteria and also rating frameworks than a normal business auto plan.

All about Whole Farm Revenue Protection

Kind A, B, C, and D.Time of day of use, usage from the home farm, ranch other restrictions various other constraints these types of vehicles. As you can see, there are numerous types of farm vehicle insurance plans available to farmers.

The Definitive Guide for Whole Farm Revenue Protection

It's important to discuss your lorries as well as their use honestly with your representative when click for info they are structuring your insurance coverage portfolio. This type of comprehensive, conversational method to the insurance acquiring process will aid to make certain that all coverage voids are closed as well as you are obtaining the best worth from your plans.Please note: Information and insurance claims presented in this material are indicated for helpful, illustratory objectives as well as must not be taken into consideration legitimately binding.

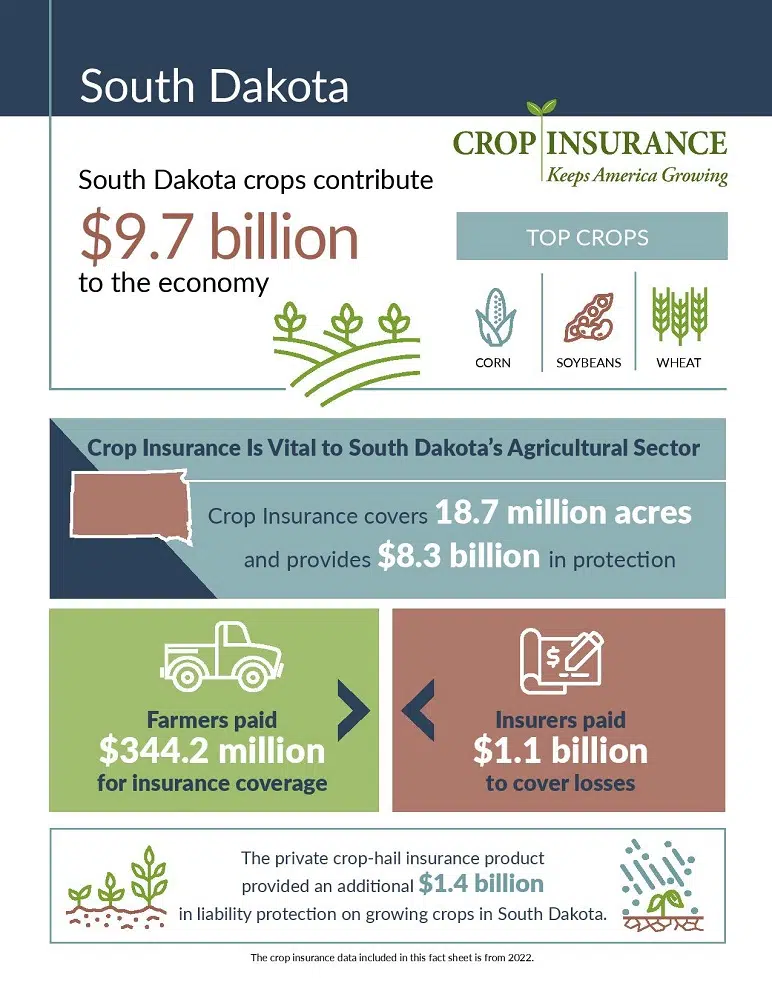

Plant hail storm coverage is offered by exclusive insurers and regulated by the state insurance policy divisions. It is not component of a federal government program. There is a federal program providing a selection of multi-peril plant insurance products. The Federal Plant Insurance program was created in 1938. Today the RMA provides the program, which offered policies for even more than 255 million acres of land in 2010.

Examine This Report about Whole Farm Revenue Protection

Unlike various other kinds of insurance coverage, plant insurance depends on well-known dates that put on all policies. These dates are figured out by the RMA ahead of the growing season as well as released on its web site. Dates vary by plant and also by region. These are the essential days farmers must anticipate to fulfill: All plant insurance coverage applications for try this out the marked region and also plant schedule by this day.Report this wiki page